Quali sono i principali indici americani? Da quali aziende sono composti?

Vai all’analisi

S&P500, NASDAQ100, Dow Jones30… mi accorgo che c’è ancora molta confusione tra gli investitori meno esperti.

Quindi spero di fare un po’ di chiarezza per tutti coloro che ancora hanno qualche dubbio su quali siano le differenze tra questi indici americani.

Prima di scendere nel dettaglio dei singoli indici vorrei assicurarmi che tu abbia ben chiaro cosa sia un indice di borsa.

Cos’è un indice di borsa?

Un indice di borsa o indice finanziario non è altro che una paniere di azioni, obbligazioni o materie prime, selezionate e raggruppate da apposite società con lo scopo di descrivere un mercato.

Facciamo qualche esempio casalingo.

Il FTSE MIB è l’indice che descrive l’andamento del mercato italiano ed è composto dalle 40 società più scambiate sul MTA (Mercato Telematico Azionario). L’indice è stato creato ed è tuttora gestito dalla società americana Financial Times.

In altre parole questa società è incaricata di dire quali società italiane sono più rappresentative del mercato italiano e di determinare l’importanza di ciascuna di esse (calcolare che percentuale ciascuna società deve avere all’interno dell’indice).

Solitamente esistono dei criteri obiettivi per definire quali società devono rientrare nell’indice e con che peso. Tuttavia non è sempre così. Per esempio la differenza mercati sviluppati e mercati emergenti non è definita da criteri obiettivi, ma dal “sentimento” delle società di investimento più importanti. Se vuoi approfondire la questione (è super interessante secondo me) ti invito a leggere questo articolo:

Cos’è l’indice S&P500?

Lo Standard and Poor’s 500, detto anche S&P500, è l’indice americano più importante e più rappresentativo del mercato Americano. Rispetto al NASDAQ e al Dow Jones (di cui parleremo dopo) infatti include un paniere di aziende molto più grande e diversificato. Come si può dedurre dal nome include oltre 500 aziende americane a grande capitalizzazione (large cap).

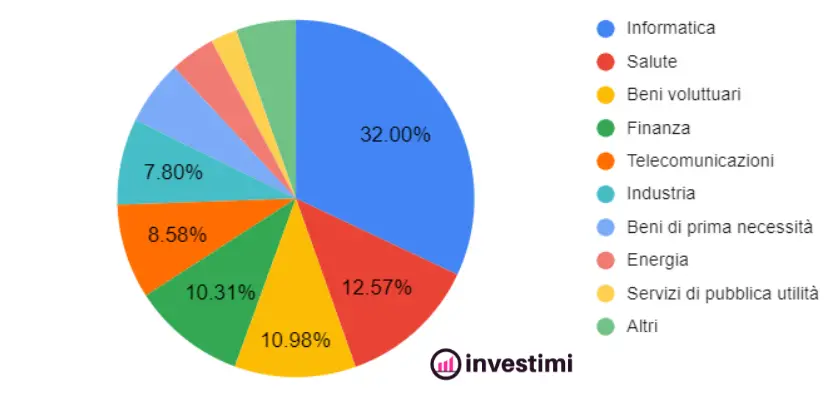

Settori S&P500

L’indice include aziende che operano in tutti i settori, anche se oltre il 25% dell’indice è composto da aziende del settore tecnologico.

| Informatica | 32.00% |

| Salute | 12.57% |

| Beni voluttuari | 10.98% |

| Finanza | 10.31% |

| Telecomunicazioni | 8.58% |

| Industria | 7.80% |

| Beni di prima necessità | 5.84% |

| Energia | 4.09% |

| Servizi di pubblica utilità | 2.39% |

| Altri | 5.44% |

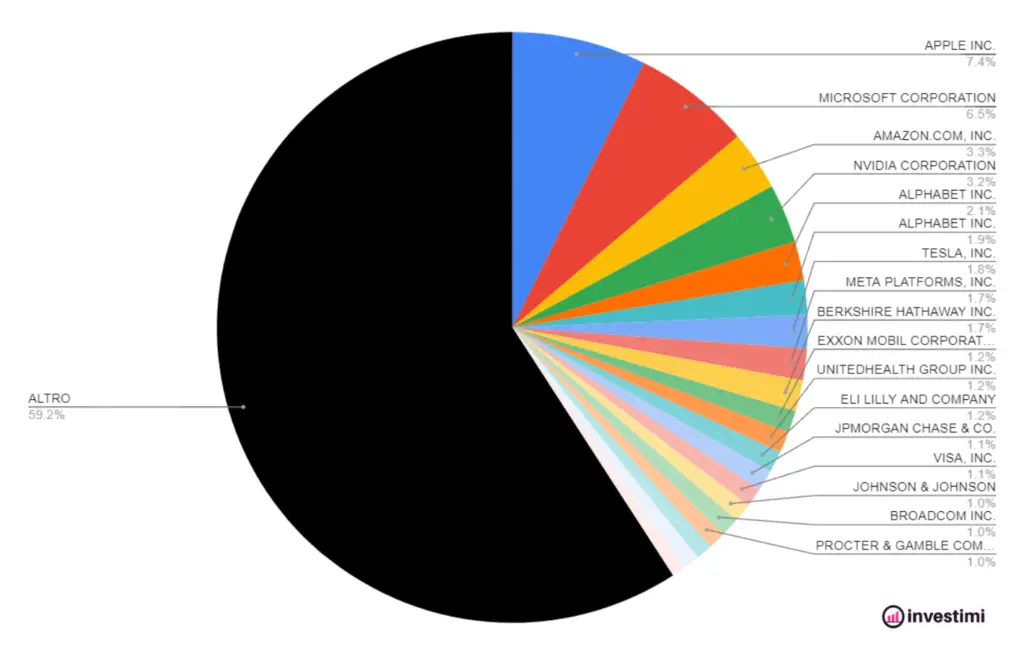

Non stupisce infatti che se andiamo a guardare le prime 20 aziende troviamo i grandi colossi tech.

Aziende e Pesi S&P500

| 1 | Apple Inc. | 6.53% |

| 2 | Microsoft Corporation | 5.54% |

| 3 | Amazon.com Inc. | 2.47% |

| 4 | Alphabet Inc. Class A | 1.77% |

| 5 | Berkshire Hathaway Inc. Class B | 1.66% |

| 6 | Alphabet Inc. Class C | 1.58% |

| 7 | Tesla Inc | 1.51% |

| 8 | UnitedHealth Group Incorporated | 1.46% |

| 9 | Johnson & Johnson | 1.37% |

| 10 | Exxon Mobil Corporation | 1.35% |

| 11 | NVIDIA Corporation | 1.25% |

| 12 | JPMorgan Chase & Co. | 1.17% |

| 13 | Procter & Gamble Company | 1.04% |

| 14 | Visa Inc. Class A | 1.03% |

| 15 | Home Depot Inc. | 0.98% |

| 16 | Chevron Corporation | 0.96% |

| 17 | Mastercard Incorporated Class A | 0.90% |

| 18 | Eli Lilly and Company | 0.85% |

| 19 | Pfizer Inc. | 0.84% |

| 20 | AbbVie Inc. | 0.83% |

| ALTRO | 64.90% |

L’indice utilizza una ponderazione per capitalizzazione di mercato dell’azienda, quindi i pesi assegnati a ciascuna azienda dipendono dal suo market cap. In altre parole l’indice da più importanza alle aziende più grosse.

Cos’è l’indice NASDAQ100?

Il NASDAQ100 è riconosciuto come l’indice tecnologico americano. Investe infatti in aziende quotate sul NASDAQ, il listino americano su cui quotano tutte le principali aziende tecnologiche e biotecnologiche.

Il NASDAQ è famoso per aver causato la Bolla delle Dot-Com nel 2001. Infatti è bene specificare che, come vedremo dopo, molte delle aziende presenti nel NASDAQ100 sono presenti anche nel S&P500.

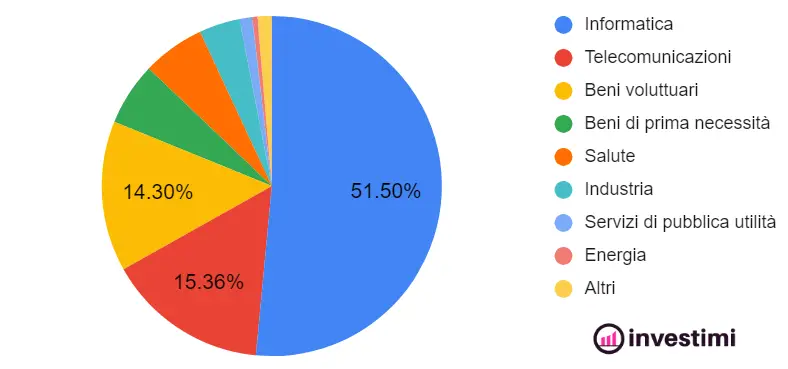

Settori NASDAQ100

Il NASDAQ100 è un indice poco diversificato a livello settoriale visto che oltre il 50% dell’indice è costituito da aziende del settore tecnologico (oltre il doppio dell’SP500). Un’altra grande fetta dell’indice, il 22% per la precisione, è costituita da aziende che lavorano nel settore dei Servizi al consumatore.

| Informatica | 51.50% |

| Telecomunicazioni | 15.36% |

| Beni voluttuari | 14.30% |

| Beni di prima necessità | 5.97% |

| Salute | 5.92% |

| Industria | 3.90% |

| Servizi di pubblica utilità | 1.20% |

| Energia | 0.49% |

| Altri | 1.36% |

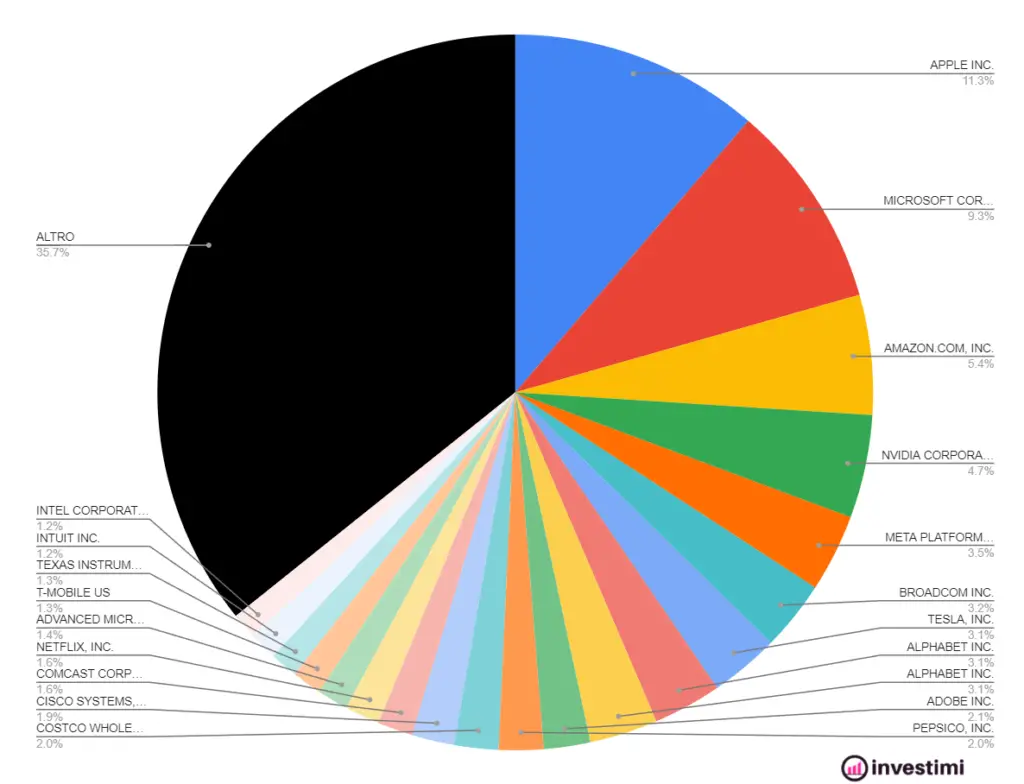

Aziende e Pesi NASDAQ100

Come abbiamo detto molte delle aziende presenti nel S&P500 sono presenti anche nel NASDAQ. I colossi del tech però qua sono presenti con pesi molto più importanti.

| 1 | APPLE INC. | 11.29% |

| 2 | MICROSOFT CORPORATION | 9.31% |

| 3 | AMAZON.COM, INC. | 5.41% |

| 4 | NVIDIA CORPORATION | 4.66% |

| 5 | META PLATFORMS, INC. | 3.51% |

| 6 | BROADCOM INC. | 3.15% |

| 7 | TESLA, INC. | 3.13% |

| 8 | ALPHABET INC. | 3.09% |

| 9 | ALPHABET INC. | 3.08% |

| 10 | ADOBE INC. | 2.10% |

| 11 | PEPSICO, INC. | 2.01% |

| 12 | COSTCO WHOLESALE CORPORATION | 2.00% |

| 13 | CISCO SYSTEMS, INC. | 1.92% |

| 14 | COMCAST CORPORATION | 1.59% |

| 15 | NETFLIX, INC. | 1.58% |

| 16 | ADVANCED MICRO DEVICES, INC. | 1.40% |

| 17 | T-MOBILE US | 1.34% |

| 18 | TEXAS INSTRUMENTS | 1.25% |

| 19 | INTUIT INC. | 1.24% |

| 20 | INTEL CORPORATION | 1.20% |

Cos’è l’indice Dow Jones Industrial Average?

L’indice Dow Jones Industrial Average (DJIA), detto anche Dow Jones o più semplicemente Dow, è un indice storico del mercato degli Stati Uniti. Il Dow Jones 30 società principalmente legate al settore industriale, inteso come produzione di beni di consumo.

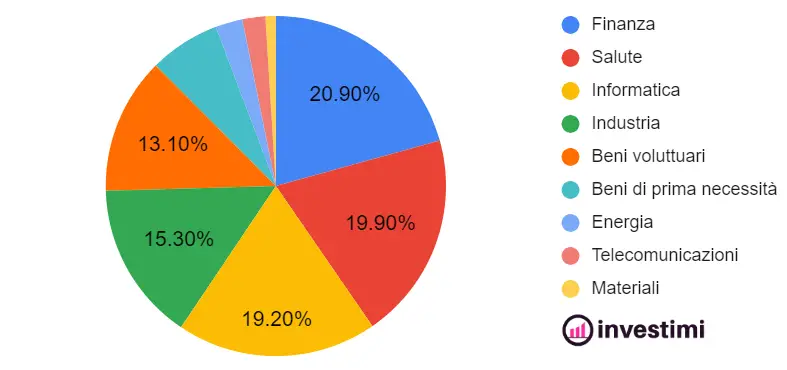

Settori Dow Jones30

Nonostante storicamente il Dow Jones sia un indice prettamente industriale, le società che vi fanno parte sono classificate sotto vari settori. Come al solito domina quello tecnologico con oltre il 20%, seguito da Indstrials, Healthcare, Financials e Consumer Discretionary con circa il 15% ciascuno.

| Finanza | 20.90% |

| Salute | 19.90% |

| Informatica | 19.20% |

| Industria | 15.30% |

| Beni voluttuari | 13.10% |

| Beni di prima necessità | 6.80% |

| Energia | 2.60% |

| Telecomunicazioni | 2.20% |

| Materiali | 1.00% |

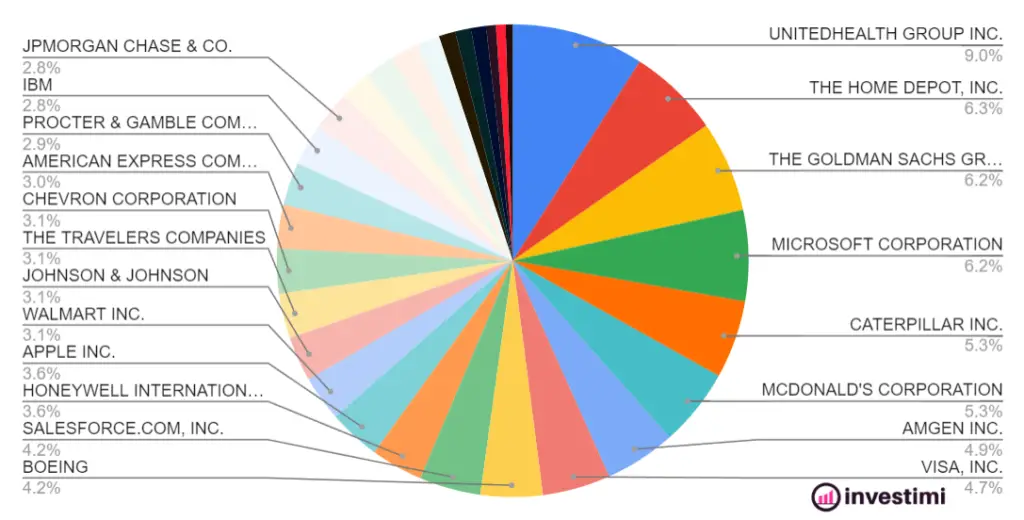

Aziende e Pesi Dow Jones30

Nel caso del Dow Jones la lista dei nomi cambia leggermente rispetto ad i soliti Facebook, Google, Amazon ecc… anche se troviamo ancora dei nomi come Apple e Microsoft.

Puoi notare anche che molte delle aziende presenti nel Dow sono dei grandi colossi industriali sul mercato ormai da decenni.

Una grande differenza tra il Dow Jones 30, il NASDAQ100 e l’S&P500 è che sia il NASDAQ che l’S&P sono indici pesati per la capitalizzazione delle aziende, al contrario il Dow Jones è pesato sul prezzo delle azioni.

| # | Società | Peso |

| 1 | UNITEDHEALTH GROUP INC. | 9.01% |

| 2 | THE HOME DEPOT, INC. | 6.24% |

| 3 | THE GOLDMAN SACHS GROUP, INC. | 6.20% |

| 4 | MICROSOFT CORPORATION | 6.19% |

| 5 | CATERPILLAR INC. | 5.31% |

| 6 | MCDONALD’S CORPORATION | 5.31% |

| 7 | AMGEN INC. | 4.84% |

| 8 | VISA, INC. | 4.64% |

| 9 | BOEING | 4.23% |

| 10 | SALESFORCE.COM, INC. | 4.19% |

| 11 | HONEYWELL INTERNATIONAL INC. | 3.55% |

| 12 | APPLE INC. | 3.55% |

| 13 | WALMART INC. | 3.07% |

| 14 | JOHNSON & JOHNSON | 3.06% |

| 15 | THE TRAVELERS COMPANIES | 3.05% |

| 16 | CHEVRON CORPORATION | 3.04% |

| 17 | AMERICAN EXPRESS COMPANY | 2.99% |

| 18 | PROCTER & GAMBLE COMPANY | 2.92% |

| 19 | IBM | 2.78% |

| 20 | JPMORGAN CHASE & CO. | 2.77% |

| 21 | MERCK & CO., INC. | 2.06% |

| 22 | 3M COMPANY | 2.02% |

| 23 | NIKE, INC. | 1.92% |

| 24 | WALT DISNEY COMPANY (THE) | 1.58% |

| 25 | THE COCA-COLA COMPANY | 1.13% |

| 26 | CISCO SYSTEMS, INC. | 1.08% |

| 27 | DOW INC. | 1.03% |

| 28 | INTEL CORPORATION | 0.66% |

| 29 | VERIZON COMMUNICATIONS | 0.66% |

| 30 | WALGREENS BOOTS ALLIANCE, INC. | 0.48% |

Lista completa titoli NASDAQ100

| # | Società | Peso |

| 1 | APPLE INC. | 11.29% |

| 2 | MICROSOFT CORPORATION | 9.31% |

| 3 | AMAZON.COM, INC. | 5.41% |

| 4 | NVIDIA CORPORATION | 4.66% |

| 5 | META PLATFORMS, INC. | 3.51% |

| 6 | BROADCOM INC. | 3.15% |

| 7 | TESLA, INC. | 3.13% |

| 8 | ALPHABET INC. | 3.09% |

| 9 | ALPHABET INC. | 3.08% |

| 10 | ADOBE INC. | 2.10% |

| 11 | PEPSICO, INC. | 2.01% |

| 12 | COSTCO WHOLESALE CORPORATION | 2.00% |

| 13 | CISCO SYSTEMS, INC. | 1.92% |

| 14 | COMCAST CORPORATION | 1.59% |

| 15 | NETFLIX, INC. | 1.58% |

| 16 | ADVANCED MICRO DEVICES, INC. | 1.40% |

| 17 | T-MOBILE US | 1.34% |

| 18 | TEXAS INSTRUMENTS | 1.25% |

| 19 | INTUIT INC. | 1.24% |

| 20 | INTEL CORPORATION | 1.20% |

| 21 | AMGEN INC. | 1.12% |

| 22 | APPLIED MATERIALS, INC. | 1.05% |

| 23 | QUALCOMM, INC. | 1.05% |

| 24 | HONEYWELL INTERNATIONAL INC. | 1.03% |

| 25 | BOOKING HOLDINGS INC. | 0.94% |

| 26 | STARBUCKS CORPORATION | 0.92% |

| 27 | INTUITIVE SURGICAL, INC. | 0.90% |

| 28 | AUTOMATIC DATA PROCESSING, INC. | 0.86% |

| 29 | MONDELEZ INTERNATIONAL, INC. | 0.80% |

| 30 | GILEAD SCIENCES, INC. | 0.78% |

| 31 | LAM RESEARCH CORPORATION | 0.77% |

| 32 | ANALOG DEVICES, INC. | 0.75% |

| 33 | VERTEX PHARMACEUTICALS INCORPORATED | 0.74% |

| 34 | REGENERON PHARMACEUTICALS, INC. | 0.73% |

| 35 | MICRON TECHNOLOGY, INC. | 0.63% |

| 36 | PALO ALTO NETWORKS, INC. | 0.61% |

| 37 | SYNOPSYS INC. | 0.57% |

| 38 | PAYPAL HOLDINGS, INC. | 0.57% |

| 39 | MERCADOLIBRE, INC. | 0.57% |

| 40 | KLA CORPORATION | 0.56% |

| 41 | CHARTER COMMUNICATIONS, INC. | 0.54% |

| 42 | CADENCE DESIGN SYSTEMS, INC. | 0.54% |

| 43 | MARRIOTT INTERNATIONAL, INC. | 0.51% |

| 44 | CSX CORPORATION | 0.50% |

| 45 | PDD HOLDINGS INC. | 0.50% |

| 46 | MONSTER BEVERAGE CORPORATION | 0.49% |

| 47 | ASML HOLDING N.V. | 0.48% |

| 48 | O’REILLY AUTOMOTIVE, INC | 0.47% |

| 49 | AIRBNB, INC. | 0.45% |

| 50 | NXP SEMICONDUCTORS N.V. | 0.44% |

| 51 | CINTAS CORPORATION | 0.42% |

| 52 | WORKDAY INC. | 0.41% |

| 53 | MARVELL TECHNOLOGY GROUP LTD | 0.41% |

| 54 | AUTODESK, INC. | 0.39% |

| 55 | KEURIG DR PEPPER INC. | 0.39% |

| 56 | FORTINET, INC. | 0.39% |

| 57 | OLD DOMINION FREIGHT LINE, INC. | 0.38% |

| 58 | LULULEMON ATHLETICA INC. | 0.38% |

| 59 | MICROCHIP TECHNOLOGY, INC. | 0.37% |

| 60 | PAYCHEX, INC. | 0.36% |

| 61 | MODERNA, INC. | 0.35% |

| 62 | PACCAR, INC. | 0.35% |

| 63 | COPART, INC. | 0.35% |

| 64 | ON SEMICONDUCTOR CORPORATION | 0.35% |

| 65 | IDEXX LABORATORIES, INC. | 0.35% |

| 66 | ROSS STORES, INC. | 0.34% |

| 67 | KRAFT HEINZ | 0.33% |

| 68 | AMERICAN ELECTRIC POWER COMPANY, INC. | 0.33% |

| 69 | ASTRAZENECA PLC | 0.33% |

| 70 | EXELON CORPORATION | 0.33% |

| 71 | SEAGEN INC. | 0.32% |

| 72 | BIOGEN INC. | 0.32% |

| 73 | BAKER HUGHES COMPANY | 0.30% |

| 74 | CROWDSTRIKE HOLDINGS, INC. | 0.30% |

| 75 | COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION | 0.30% |

| 76 | THE TRADE DESK, INC. | 0.29% |

| 77 | VERISK ANALYTICS, INC. | 0.29% |

| 78 | CONSTELLATION ENERGY CORPORATION | 0.28% |

| 79 | COSTAR GROUP, INC. | 0.28% |

| 80 | FASTENAL COMPANY | 0.27% |

| 81 | ELECTRONIC ARTS INC. | 0.27% |

| 82 | WARNER BROS. DISCOVERY, INC. | 0.26% |

| 83 | XCEL ENERGY INC. | 0.26% |

| 84 | ATLASSIAN CORPORATION | 0.25% |

| 85 | GLOBALFOUNDRIES, INC. | 0.25% |

| 86 | DATADOG, INC. | 0.23% |

| 87 | ALIGN TECHNOLOGY, INC. | 0.23% |

| 88 | ANSYS, INC. | 0.23% |

| 89 | DIAMONDBACK ENERGY, INC. | 0.23% |

| 90 | DOLLAR TREE, INC. | 0.22% |

| 91 | ILLUMINA, INC. | 0.21% |

| 92 | EBAY INC. | 0.20% |

| 93 | ZSCALER, INC. | 0.19% |

| 94 | WALGREENS BOOTS ALLIANCE, INC. | 0.18% |

| 95 | ZOOM VIDEO COMMUNICATIONS, INC. | 0.15% |

| 96 | ENPHASE ENERGY, INC. | 0.14% |

| 97 | SIRIUS XM HOLDINGS INC. | 0.14% |

| 98 | JD.COM, INC. | 0.12% |

| 99 | LUCID GROUP, INC. | 0.12% |

Lista top 100 titoli S&P500

| # | Società | Peso |

| 1 | APPLE INC. | 7.36% |

| 2 | MICROSOFT CORPORATION | 6.45% |

| 3 | AMAZON.COM, INC. | 3.26% |

| 4 | NVIDIA CORPORATION | 3.23% |

| 5 | ALPHABET INC. | 2.14% |

| 6 | ALPHABET INC. | 1.86% |

| 7 | TESLA, INC. | 1.84% |

| 8 | META PLATFORMS, INC. | 1.73% |

| 9 | BERKSHIRE HATHAWAY INC. | 1.70% |

| 10 | EXXON MOBIL CORPORATION | 1.19% |

| 11 | UNITEDHEALTH GROUP INC. | 1.18% |

| 12 | ELI LILLY AND COMPANY | 1.16% |

| 13 | JPMORGAN CHASE & CO. | 1.13% |

| 14 | VISA, INC. | 1.05% |

| 15 | JOHNSON & JOHNSON | 1.03% |

| 16 | BROADCOM INC. | 1.02% |

| 17 | PROCTER & GAMBLE COMPANY | 0.96% |

| 18 | MASTERCARD, INC. | 0.91% |

| 19 | THE HOME DEPOT, INC. | 0.89% |

| 20 | CHEVRON CORPORATION | 0.76% |

| 21 | MERCK & CO., INC. | 0.73% |

| 22 | ABBVIE INC. | 0.69% |

| 23 | ADOBE INC. | 0.68% |

| 24 | PEPSICO, INC. | 0.65% |

| 25 | COSTCO WHOLESALE CORPORATION | 0.65% |

| 26 | CISCO SYSTEMS, INC. | 0.62% |

| 27 | THE COCA-COLA COMPANY | 0.62% |

| 28 | WALMART INC. | 0.60% |

| 29 | SALESFORCE.COM, INC. | 0.57% |

| 30 | THERMO FISHER SCIENTIFIC | 0.57% |

| 31 | MCDONALD’S CORPORATION | 0.54% |

| 32 | ACCENTURE PLC | 0.54% |

| 33 | PFIZER, INC. | 0.53% |

| 34 | BANK OF AMERICA CORPORATION | 0.53% |

| 35 | COMCAST CORPORATION | 0.52% |

| 36 | NETFLIX, INC. | 0.51% |

| 37 | LINDE PLC | 0.50% |

| 38 | ORACLE CORPORATION | 0.49% |

| 39 | ABBOTT LABORATORIES | 0.47% |

| 40 | DANAHER CORPORATION | 0.47% |

| 41 | ADVANCED MICRO DEVICES, INC. | 0.45% |

| 42 | WELLS FARGO & COMPANY | 0.41% |

| 43 | WALT DISNEY COMPANY (THE) | 0.41% |

| 44 | TEXAS INSTRUMENTS | 0.40% |

| 45 | INTUIT INC. | 0.40% |

| 46 | PHILIP MORRIS INTERNATIONAL, INC. | 0.40% |

| 47 | VERIZON COMMUNICATIONS | 0.39% |

| 48 | INTEL CORPORATION | 0.39% |

| 49 | CATERPILLAR INC. | 0.38% |

| 50 | CONOCOPHILLIPS | 0.38% |

| 51 | LOWE’S COMPANIES, INC. | 0.36% |

| 52 | AMGEN INC. | 0.36% |

| 53 | NEXTERA ENERGY | 0.36% |

| 54 | UNION PACIFIC CORPORATION | 0.36% |

| 55 | IBM | 0.35% |

| 56 | BRISTOL-MYERS SQUIBB COMPANY | 0.34% |

| 57 | APPLIED MATERIALS, INC. | 0.34% |

| 58 | S&P GLOBAL, INC. | 0.34% |

| 59 | QUALCOMM, INC. | 0.34% |

| 60 | BOEING | 0.34% |

| 61 | RTX CORPORATION | 0.33% |

| 62 | NIKE, INC. | 0.33% |

| 63 | HONEYWELL INTERNATIONAL INC. | 0.33% |

| 64 | GENERAL ELECTRIC COMPANY | 0.33% |

| 65 | UNITED PARCEL SERVICE INC. | 0.33% |

| 66 | SERVICENOW, INC. | 0.32% |

| 67 | PROLOGIS, INC. | 0.30% |

| 68 | BOOKING HOLDINGS INC. | 0.30% |

| 69 | STARBUCKS CORPORATION | 0.30% |

| 70 | MORGAN STANLEY | 0.29% |

| 71 | DEERE & COMPANY | 0.29% |

| 72 | INTUITIVE SURGICAL, INC. | 0.29% |

| 73 | THE GOLDMAN SACHS GROUP, INC. | 0.29% |

| 74 | MEDTRONIC PLC | 0.29% |

| 75 | THE TJX COMPANIES | 0.28% |

| 76 | AT&T INC. | 0.28% |

| 77 | AUTOMATIC DATA PROCESSING, INC. | 0.28% |

| 78 | BLACKROCK, INC. | 0.28% |

| 79 | ELEVANCE HEALTH, INC. | 0.28% |

| 80 | LOCKHEED MARTIN CORPORATION | 0.27% |

| 81 | MONDELEZ INTERNATIONAL, INC. | 0.26% |

| 82 | MARSH & MCLENNAN COMPANIES | 0.26% |

| 83 | STRYKER CORPORATION | 0.25% |

| 84 | GILEAD SCIENCES, INC. | 0.25% |

| 85 | LAM RESEARCH CORPORATION | 0.25% |

| 86 | AMERICAN EXPRESS COMPANY | 0.25% |

| 87 | ANALOG DEVICES, INC. | 0.24% |

| 88 | EATON CORPORATION PLC | 0.24% |

| 89 | VERTEX PHARMACEUTICALS INCORPORATED | 0.24% |

| 90 | REGENERON PHARMACEUTICALS, INC. | 0.24% |

| 91 | CHARLES SCHWAB | 0.23% |

| 92 | ZOETIS INC. | 0.23% |

| 93 | AMERICAN TOWER CORPORATION | 0.22% |

| 94 | SCHLUMBERGER LIMITED | 0.22% |

| 95 | CVS HEALTH CORPORATION | 0.22% |

| 96 | CHUBB LIMITED | 0.22% |

| 97 | THE CIGNA GROUP | 0.22% |

| 98 | CITIGROUP INC. | 0.21% |

| 99 | BECTON, DICKINSON AND COMPANY | 0.21% |

| 100 | ALTRIA GROUP, INC. | 0.21% |